Dracula presents a dark, modern reinterpretation of the classic vampire tale, blending gothic horror with psychological depth and stylish storytelling.

Dracula is a gothic thriller starring Claes Bang, blending horror, dark humor

Click Here to Add Gadgets360 As A Trusted Source

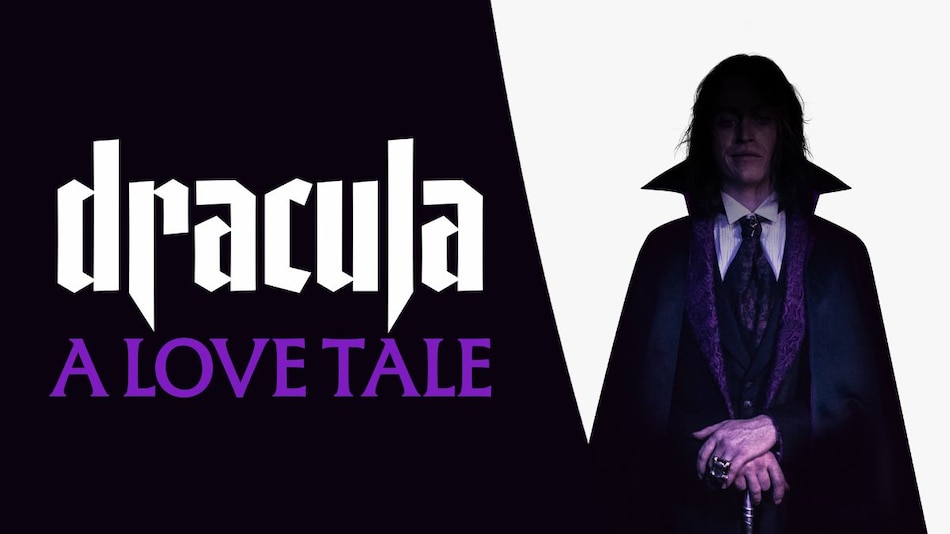

Dracula: A Love Tale is a French Gothic romance tale with romantic fantasy elements. It is written and directed by Luc Besson. It has been adapted from the novel Dracula, written by Bram Stoker. It stars with Christopher Waltz and Zoe Bleu. theatrically it was released on July 30, 2025. The story takes you centuries back, where the film gets supernatural mystery, with an emotional storytelling approach. It is about the poetic and fresh Dracula who is forever longing for love.

When and Where to Watch

It is now out on Amazon Prime Video to watch. It was released theatrically on July 30, 2025.

Trailer and Plot

The official trailer of this drama is about the chilling tone and eerie scenes in the backdrop of a gothic culture. The plot would move you on Dracula’s journey, whose wife is no more, and years after he turned into a vampire and sees a woman who looks like his wife. Now he wants to get her. He moved from Transylvania to England. He encounters people who challenge him and has a tweaked relationship with humanity. It has horror, dark humour, and it gives a psychological vibe with a fresh take on the myth.

Cast and Crew

The series has Luc Besson as the director. Caleb Landry Jones, Christoph Waltz, Zoë Bleu, Matilda De Angelis, Ewens Abid, David Shields, Guillaume de Tonquédec, Bertrand-Xavier Corbi and others.

Reception

Dracula has many praises for its wonderful gothic representation and storytelling approach, with an IMDb rating of 6.2 out of 10.